Preparing a Bank Reconciliation Financial Accounting

Content

Either way, it means the money doesn’t end up in the check recipient’s account. The payer is usually charged a fee for bouncing a check, and sometimes the recipient is, too. Draw attention to accounts receivable problems.

Check your receipts to find any cash receipts that were not automatically recorded by the bank. In many states, corporations, LLCs and other business entities must file an annual report. Follow our step-by-step guide to learn how to file an annual report and ensure your business stays compliant with https://kelleysbookkeeping.com/ state regulations. Opening an LLC bank account shouldn’t be difficult, provided you do your research and bring the proper papers. A general ledger is simply a master document containing all of a company’s transactions neatly categorized. Let’s see how it works and how it can work for your business.

How To Do Bank Reconciliation in 4 Steps [Example+Template]

Uncredited deposit is not a term we use in the U.S. From a quick google search, they seem to be the same thing. Deposit in transit is used on the bank side of the reconciliation when a deposit has been recorded on the books but has not been recorded by the bank. Cheque no. 998 is returned with the bank statement. The cheque was made for $350, the correct amount owing for office expense.

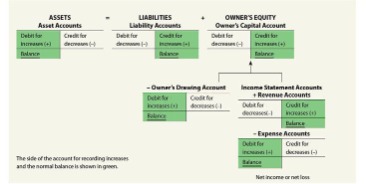

Bank reconciliation is indispensable to accrual accounting. Your annual report requires seven digits for all account codes however, their display in the chart of accounts export varies. The expenditure or expense accounts are presented in the export without object codes. Object codes will need to be added to the BARS Code to complete the required seven digits for the annual report.

Example #2 of Bank Reconciliation Statement Template

Once deposited, checks may take several days to clear the banking system. Determine the outstanding checks by comparing the check numbers that have cleared the bank with the check numbers issued by the company. Use check marks in the company’s record of checks issued to identify those checks returned In A Bank Reconciliation, Deposits In Transit Should Be by the bank. Checks issued that have not yet been returned by the bank are the outstanding checks. If the bank does not return checks but only lists the cleared checks on the bank statement, determine the outstanding checks by comparing this list with the company’s record of checks issued.

- Resources that consist of coins, currency, checks, money orders, and money on hand or on deposit in a bank or similar depository.

- Fixed budgets must be adopted by ordinance or resolution, either for the government’s fiscal period or at the outset of a service project, debt issue, grant award, or capital project.

- A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370.

- If you did not want to reinstate the A/P balance, you could credit the expense account used in the initial recording of the bill.

- An outstanding check is when a company has received but hasn’t yet deposited in the bank, or a deposited check that hasn’t yet been cleared through the banking system.

A day’s cash receipts recorded in a depositor’s books in one period but recorded as a deposit by the bank in the following period. Add back any receipts for deposits in transit from a company to the bank, which have been paid in but not yet processed by the bank. If you void a sale, you need to credit cash and debit the income account.

Example #1 of Bank Reconciliation Statement Template

The bank deducted $25 for this service, so the automatic deposit was for $1,565. The bank statement also includes a debit memorandum describing a $253 automatic withdrawal for a utility payment. On the bank reconciliation, add unrecorded automatic deposits to the company’s book balance, and subtract unrecorded automatic withdrawals. The bank reconciliation process has three basic steps. The first is comparing the cash balances and transactions on the company’s books to the cash balances and transactions listed on an external bank statement. Because of things like electronic transfer fees, outstanding checks and deposits and different cut-off periods, the two rarely match.